Let me start with the conclusion: I believe the current situation can either be addressed through a change of dynasty or war or a brand new technology revolution (but I don’t see any short-term stimulus), or smoothed over by long-term inflation (50-70 years or above).

As a 26-year-old, I'd rather witness a war of severe casualties, something I've never seen in my life. It seems less fun to go through life without ever grappling with life and death.

To preface:

My perspective on institutional issues has always been that no system can be perfect. Just like the three-body problem, there's no exact solution, only approximate ones, and a tiny initial disturbance can quickly lead to unexpected breakdowns. Human society is composed of game theory; if a perpetual motion machine does not exist, then there must be a losing side outside of the game, whether it's a living creature or not. The nature of establishing policies for pensions I've discussed before, and the nature of formulating China's economic policies that I'm going to discuss today, are essentially the same. Both are a result of an initial social disturbance, where the then middle-aged group (those in power) make decisions more in line with their own group's interests. As the power holders age, they pass on the blood-drained society to their successors and the cycle continues, draining blood incessantly until they can no longer drain blood. At this point, they resort to war (extreme power holders) or long-term moderate policies (non-extreme power holders) to get through. I think if China or the Chinese community continues to exist, war will be the preference of the leaders because the cost of war is borne by young people, while the beneficiaries or potential beneficiaries remain the power holders of the future.

I write this paragraph because the economy of China (or major global economies) follows this pattern, whether it's capitalist or socialist (I've written about this before, the main difference between the two in dealing with the public is the degree of brainwashing and information transparency: in capitalism, the power holders try to divert the public's attention away from their important parts through monopoly, to increase the wealth gap; in socialism, the power holders attempt to confine the public, using various means to erase their "bad" thoughts, also to increase the wealth gap). Let's move on to discuss the overall logic - the cycle and iteration process of China's economy over the past 20 years - and why an initially orderly system has turned into the chaos we see today:

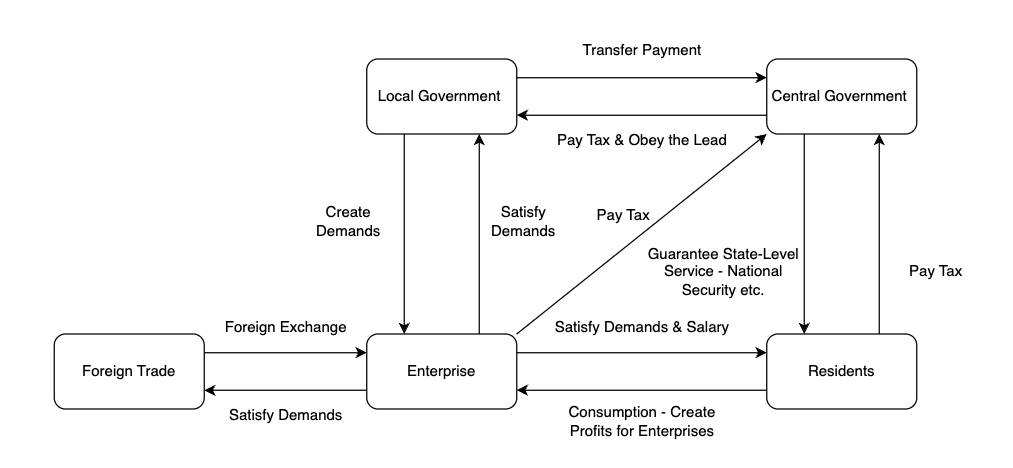

(Note: The entire model has been greatly simplified, retaining only the main elements after "averaging", to highlight the main contradictions)

For China, with its vast land, rich resources, large population, and deep-rooted traditional concepts, the lack of essential materials is a characteristic, which has gradually shaped the two cornerstones of the Chinese economy:

- External Trade Cycle → Obtaining foreign exchange and resources to facilitate economic growth.

- Internal Cycle → The interplay between residents, government, and businesses creating mutual demand and income, thus maintaining the operation of the economy.

Let's first discuss the internal cycle:

The three major roles of government, businesses, and residents each have their rights and obligations:

- Government:

- Rights: Tax collection.

- Obligations: Spend the collected taxes in the form of fiscal expenditure, which involves two aspects:

- Create demand through government procurement and other means to stimulate business growth.

- Provide public services to residents, such as healthcare, pensions, defense, etc.

- Businesses:

- Rights: Meet the demands of the government & the needs of the resident sector.

- Obligations: Pay taxes to the government & provide salaries to their employees.

- Residents:

- Rights: Receive public services from the government & earn income from businesses or government sectors through labor.

- Obligations: Pay taxes to the government & invest their income in living or production, creating new demand for businesses.

The above points are the most important extracts. Obviously, the situation in China is much more complex than this, because it is indeed vast.

So a topic that cannot be avoided is the relationship between local governments and the central government. It feels a bit like the system of feudal jurisdictions in high school history class.

Although the central government enjoys the right to tax, it is difficult for it to serve every aspect of society. Therefore, there has always been a relationship (contradiction) between the central and local levels since ancient times. As a side note, my model ignores the factor of disobedience from local governments, but in reality, this is not to be overlooked. There are countless examples of this, from a local area not following commands and unilaterally extending the maximum age for mortgage repayments to 80 years old, to Guangdong's refusal to implement the tax-sharing reform in 1993-94. Here, let's talk about the tax-sharing reform: After the trial of tax and profit diversion in the early 1980s, state-owned enterprises paid taxes, and the comprehensive contract policy (one benefits more if he has more outputs) stimulated the enthusiasm of local governments. However, due to inadequate supervision systems, local governments underreported income, putting the central government at a disadvantage in fiscal revenue, and the financial difficulty was very apparent. From 1988 to 1990, the central government even borrowed from local governments for three consecutive years. It was then that Finance Minister Liu Zhongli told Prime Minister Zhu Rongji that we need financial and tax reforms, and we must let local tax revenue (profits) pass through the hands of the central government. I think the tax-sharing system is very important because a powerful central government is very important for a country that is full of waste and waiting to be revitalized. Although it may lead to excessive centralization after reaching a moderately prosperous society...

The meaning of the tax-sharing system is to redistribute the responsibilities and fiscal powers between the central government and local governments, with different taxes belonging to the local and central governments. The tax reform in 1994 actually started to be promoted in various provinces from mid-1993. But during the promotion process, Guangdong Province was very resistant. However, they do have the power to resist because the fiscal contract system in the economically developed regions of the south is very successful, and for those already benefiting a lot, naturally they hate to change. If a large piece of the cake in Guangdong Province is directly taken away, it is equivalent to directly allocating Jerusalem out of Israel! In the end, Deputy Prime Minister Zhu Rongji (Zhu Rongji didn't become the prime minister until 1998 when Li Peng couldn't do it) made a lot of compromises to get the financial power-holder in Guangdong Province to agree (I guess he didn't expect the stress to be so harmful, and the subsequent economy would be so good...). It can be seen that the phenomenon of local governments not following the requirements of the central government is very common (especially in 2022 and 2023, when the locals can't survive if following the unclear covid policy, who cares about the central policy! - Real estate + local debt + covid)

Now that our model includes local governments: the rights and obligations of local governments and the central government are:

- Local Government:

- Rights:

- Receive allocated fiscal resources (so-called transfer payments)

- Obligations:

- Follow the leadership of the central government

- Substitute the central government in creating demand for various businesses

- Provide public services to residents

- Rights:

The above are all elements of the internal cycle. The external cycle mainly relates to the relationship between foreign trade and the business side, and it does not directly relate to residents, the central government, and local governments.

- Foreign Trade (Abroad) and Business:

- Businesses meet foreign demand

- Foreign companies pay in foreign currency (reserve)

Here is a diagram:

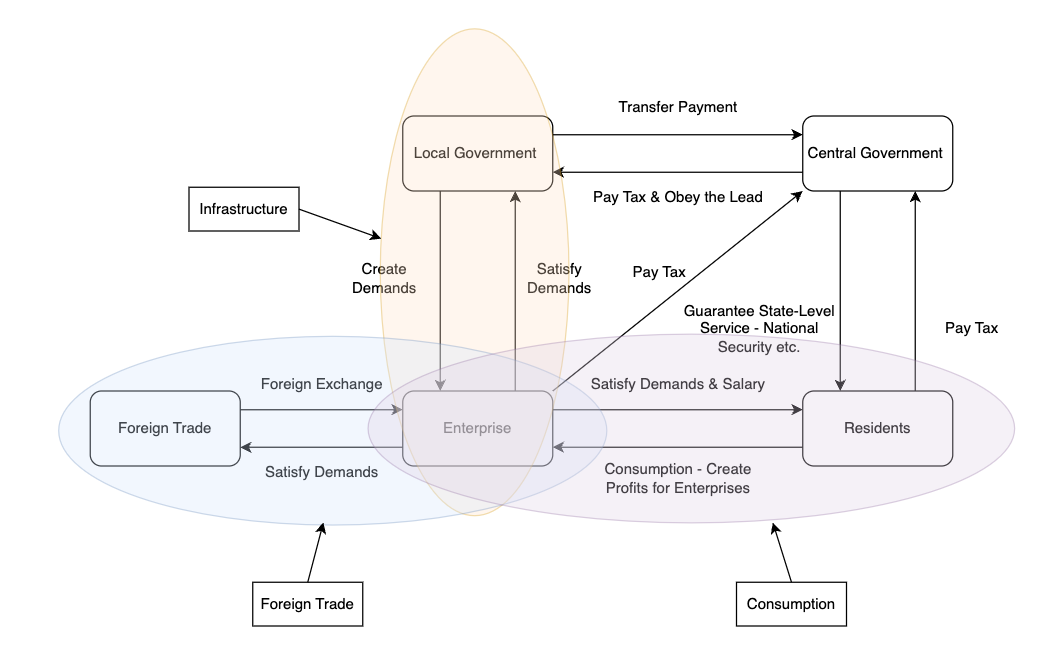

Everyone knows about the three engines of economic growth. If they are represented in the diagram, they will look like this:

At the core of these three elements is business, which means economic development (Ancient people realized the importance of the economy long ago, otherwise, there wouldn't always be a focus on economic development through out Chinese history).

Here, I suddenly want to mention a story about women's rights in Japan from the 1980s to 1995-1998. Women's rights in Japan at the time can be said to be very crazy, irrational and red-eyed. On the subway, a man accidentally bumping into a woman would lead to a police report, a lawsuit, and the man being forced to resign. Even a supervisor sending an email to discuss work would be considered harassment. But in the end, how did this so-called women's rights movement decline? Because the economy was not good. When the economy was good, women could still act recklessly, but still had money to support their families. However, when the economic bubble burst, companies stopped hiring, and the first to be laid off were those who had no abilities and only relied on rhetoric. Without an economic source, everything returned to its original form, and the previous idea that "a woman needs to have 4 boyfriends" also changed to "as long as he doesn't commit domestic violence or have an affair, it's okay." Therefore, economic development is very important and has a real impact on society's confidence and changes in ideas.

Relying on these three elements, China achieved ultra-high-speed development 15 years ago, and it was relatively benign. I can say that the bull market in the second half of 2014 was the last sign that the economy had no way back. China's economy has grown at a high speed for 30 years, and it cannot possibly become a perpetual motion machine. But after 2015, the population increased, people needed jobs, and society had to develop to accommodate these people. However, the natural growth of the economy has reached its limit (Of course, this is a conclusion drawn from now. At the time, a few indicators indeed showed a certain degree of crisis, but what people expected was just the next bull market. And the first thing Xi did after taking office in 2013 was anti-corruption and promoting integrity, which was the center of the political arena, and the economy continued as usual, with no new particularly explosive points - here I think of an interesting topic from the year before (yes, the GME event has been two full years! It happened in February 2021!). The war between GME retail investors and institutions, the CFA holder who wrote the initial analysis report, used the most solid evidence that going long on GME could bring huge profits, that is, at the time 140% of GME shares had been shorted, so once it rose, it would likely cause all the short positions to be liquidated and the broker or someone else would have to buy in frantically to close the position. What I want to say is that if this ratio is 99%, although it is high, there is still a high probability that a short squeeze will not occur, but 101% can 100% rely on increasing the stock price to cause a short squeeze, an extra 1% will have a very significant effect, because there is always some part that is going to die, everyone will flee in panic and then raise the price. What I want to express with this example is that when the mainstream local governments officially enter the era of issuing debts to stimulate social economic development, the difference between "total interest amount needed to pay being 99% of the local government's fiscal revenue" and "being 101% of the revenue" will be extremely huge in the future).

Continue, in 2015 we had already reached the limit of natural economic growth. To maintain high-speed growth, there are generally two methods:

- Productivity & Technology Revolution

- This includes productivity advances, high and new technology, etc.

- It's relatively slow and relies heavily on luck, because whether a country can produce a groundbreaking scientist often relies on luck.

- Remember the former Industry 4.0? Why is no one mentioning it now? Because there's been no progress! The resources have been squandered!

- Debt Expansion to Create More Demand - To Maintain Economic Growth

- This is simple, efficient, and in line with the short-term interests of those in power (leave future issues to future generations, game theory is indeed profound)

- Note that economic growth here has become a concept in economic data, because it has been detached from the core needs of residents, just like the increase in M2 is so large, but people don't feel that the money in their hands is increasing.

There are two main ways to expand debt:

- Grant local governments the right to issue local bonds, then invest the money raised in infrastructure to create demand and stimulate enterprise growth

- Sell land, convert it into commercial housing, transfer it to the resident sector, let residents carry a 30-year loan, spend the money of the future now. Therefore the total debt and corporate demand will rise at once

These two methods provided a lot of energy for China after 2015. Looking globally, mainstream economies operate in this way. I think this model is destined to collapse in its design, but since everyone around the globe is doing it, it's certainly better for us to do the same. It's just a pity that our good beginning didn't ultimately evolve into other countries listening to us and working for us. This debt-raising model has developed rapidly after 15 years, accelerating too quickly and ultimately it will definitely collapse. On the surface, it's because the debt-raising government no longer cares about the investment return rate, as long as it doesn't default during their own term. Our local governments, due to the previously mentioned reason that those in power are only responsible for maximizing their own term's interests, unsurprisingly, this model eventually lost control.

Regarding the process of losing control, I think it can be divided into three stages:

First stage: The borrowed money can be repaid, at least it can generate enough cash flow to pay interest.

Second Stage: We start to disregard the return rate, and slowly, in order to keep the operation going, we borrow new to pay old debts to barely survive. Moreover, in order to get more money, local governments have to raise the land prices in some previous suburb areas, sell it at a higher price to real estate developers, and then sell it to residents. Thus, the government receives more income, and residents take on more debt in a short time. At this time, the main roles in the entire economy, residents, governments, and businesses, are all burdened with huge debts, increasingly owing more, and it's becoming increasingly difficult to maintain economic growth.

-

The results of the second stage are:

- A large amount of local debt and urban investment debt are unable to pay interest, the most famous example was last December, Zunyi Daoqiao Investment’s nearly 15.6 billion yuan debt was extended for 20 years, and only interest was paid in the first 10 years, directly showing us the reality that even state-owned companies can't repay their debts. However, even if they can't pay the interest, local governments still have to continue to borrow heavily to complete this Ponzi scheme, because as said before, it doesn't matter as long as there's no default during their term. In this way, the loans lent by local banks (whose role was originally the ATM of local governments) are increasing, and the systemic risk is getting bigger.

- The overall economy is growing slower and slower (like drug addiction, in the end, even if you take twice the dose, the pleasure might only be 10% more than before, the benefit is very poor! The basic economic law of almost any industry conforms to the law of diminishing marginal returns, but unfortunately the nature of a society ruled by people is a game, and those in power will only be good to themselves), but the demand for funds is more and more, forcing the central bank to lower the reserve requirement ratio and interest rates, which made the monetary policy useless to regulate on both sides (originally, it can adjust the money supply through loosening or tightening policy, but now as long as it doesn't loosen the loans, all will fuck up - loosening is roughly equivalent to lowering interest rates is roughly equivalent to the cost of previous debts becoming high, fixed income is also reduced, so local government are more unable to repay loans).

- A new wealth group has emerged: the infrastructure aristocracy. With a lot of money poured into infrastructure, along with various local operations, we saw the bull market of real estate over the past decade, forcing young people to use six wallets (money from parents, grandparents and husband & wife) plus thirty years mortgage to buy a housing. This high personal debt caused the consumption directly stall. But here we also need to distinguish, because there are indeed many people that benefited a lot from this infrastructure investment (homeowners or early house buyers / speculators, etc.), making the wealth gap wider.

Third Stage: This is our current stage. Local governments have a hard time financing due to frequent defaults, and investors no longer wants to lend money to the government, only the central bank can finance local governments with administrative orders. And governments’ land finance (making money by selling lands) has also drained residents' past income and future income, so it is also rapidly shrinking. At this point, the entire cycle (residents, local governments, businesses) is in a state of extreme instability, the central bank can only continuously loosen to prevent large-scale defaults, and social contradictions are greatly intensified (because the young labor force mainly finds that their efforts are not proportional to the rewards they receive, so they choose to couch potato (decline to work hard in the rat race and just do nothing everyday) and criticize the social inequality. As for why the effort and reward are not proportional in this era, this is mainly because the economic situation is not good, the resident sector lacks money (not because society lacks money: look at the exploding M2), and the savings rate is constantly rising: no one is consuming, most residents can't make money).

At this time, some biased experts (intentionally) jumped out to criticize young people for lying flat, but did not mention their horrible living environment and current economic situation, and the current bad economic environment is not caused by the young, nor should young people be responsible for it. And compared to the strikes in England and France, the assassinations in the United States, Chinese young people are already the mildest sheep in the world.

In summary, the past decade's approach of debt-fueled development can no longer be sustained. The idea of developing an economy through internal circulation is utterly impossible under the current circumstances.

Here are the major economic issues that exist at present:

- Local debt - How can we trust that future generations won't trigger a debt crisis? Or as I mentioned before, are we heading into China's lost three decades, or even a war?

- Demographic shift - Soon, 200 million rural migrant workers will retire (what can those 50s-60s who used to work on infrastructure projects do when they get old?), how do we solve this? Raise the retirement age? Introduce personal pension contributions? Another Ponzi scheme within a Ponzi scheme?

- How to resolve social wealth inequality? This is linked to potential hyperinflation crisis and public security issues.

- What will be the new drivers for economic growth? Is it ChatGPT? Of course not, because China lacks substantial, groundbreaking technology that could force the U.S. to invest heavily to compete. What about 5G? Let's not joke, the costs of 4G base stations haven't even been recovered yet and we are talking about developing 5G. Without central government financial support, who would build 5G? Rare resources? Be clear, it's not that other countries don't have rare resources, but they just have less. China's rare resources can't attain the status of Middle Eastern oil. High-speed rail? Beidou Navigation? Supercomputers? Hybrid Rice? Quantum communication? Controlled nuclear fusion? There are so many I can think of, after all, I was brainwashed by the state media and major self-media... But which ones are genuinely groundbreaking, and not just for embezzling funds?

- How to solve the problem of young people's high pressure and difficulty in buying houses? Of course, this can't be solved, only time can heal everything.

Addressing these problems is difficult, but there might be some strategies:

Short term: Try our best to keep the economy circulating. A poor cycle is still better than no cycle at all. This is also why the central government has ordered to secure housing, rescue real estate companies, and lower loan interest rates, to ensure that the economy does not face systemic risks for now.

Mid-term: Shift fiscal power from infrastructure to the residential sector. This transition is challenging, as it does not align with the short-term interests of those in power. For instance, increase pensions for rural people, reduce taxes, build better kindergartens, provide medical insurance, etc., allowing them to have more money for consumption.

Long term: Maintain social stability, use inflation to gradually dissolve the huge debt of local governments, even though the ones who will ultimately suffer are the residents. Then quietly wait for the next round of technological revolution! (Here's something about the classical economic cycle theory: Kondratiev's 60-year cycle, Kuznets's 20-year cycle - also known as the building industry cycle, and Kitchin's 3-4 year minor cycle. This theory of large, medium, and small cycles was quite accurate over the past 200 years, and the large cycles are always triggered by new scientific and technological revolutions. From the perspective of large cycles, 1800-1860 was the steam age, 1860-1920 the steel and automobile age, 1920-1980 the electrification and chemical industry age, 1980-2040 the information and internet age. The mid-term cycle is also very accurate, even including World War I and II. Looking from 1960, 1970-1990 was the rapid development period after World War II, the growth of the Four Asian Tigers (a term mainly used from the late 1960s to 1990), then the internet bubble and Asian economic crisis in 1995, 1997 were the low points of the mid-cycle. Following that, 2000-2020 was a rebound from the low point, the explosive expansion of the internet, rapid devaluation of money, rapid improvement in the quality of life, and then we encountered the 2020 COVID-19. Even without COVID-19, an economic crisis was inevitable. COVID-19 is merely a fuse: having such a high debt rate and such an unstable system, a collapse will happen)

In traditional Chinese beliefs, high welfare policies are not good as they foster laziness. However, we have gone to the extreme in this aspect. Now it is impossible to foster laziness with high welfare. Instead, we are punishing hardworking people with low welfare and low security.

This article is now finished. It discusses the rapid development process of the last century, the watershed of 15 years ago, the current crisis, and future judgments.

Here are some random thoughts:

- Anyone who talks about the 'big picture' in places where there are conflicts of interest is a liar: Because development can only be regulated through systems. Interactions between individuals should ideally only take game theory into consideration. Anyone who argues for a certain 'big picture' perspective is essentially guiding you towards a direction that is not in your favor.

- In the real estate market, don't trust any policy other than price reductions. Such smokescreen policies only guide you to make irrational decisions. Market laws tell us that when supply exceeds demand, prices will drop. Any administrative measures will eventually lead to conflict, and inefficiency will appear. Policies like reducing mortgage interest rates are essentially providing opportunities for those who were previously unable to afford housing to indirectly increase their leverage more and buy houses they fundamentally can't afford, which in turn helps local governments generate revenue and repay debts - it's the same routine as the 2008 subprime mortgage crisis.

- The “massive” default on mortgage hyped up by we-media outlets won't cause systemic risk. It's easy to understand because the amount is not large, so don't be misled by the we-media. Those really affected by the default may be some local banks with a higher rate of bad loans, which could make the bank cross the red line and trigger warnings from the central bank. This might result in outside leaders taking over the management, fines, imprisonment of the original bank president, or direct takeover. But none of these will trigger systemic risks. Last year, some people hyped up the alleged troubles of Nanjing Bank, saying it issued a lot of real estate debt but still had a good balance sheet, thus it must have been falsifying its records, etc. My point is, even if they falsified the records, even if a head of one of the original Big Four asset management companies was appointed to substitute the original leader, it would only be a local issue, not a big deal.

- Natural laws are hard to break, and trends are results of these natural laws, equally hard to break. I'll use an example from another industry that's quite interesting:

- Why is Kang Shifu's braised beef noodles the best selling in the instant noodle industry? Actually, braised beef is something that Taiwan passed on to the mainland, but it's quite baffling because Taiwan traditionally didn't eat beef between the 1950s and 1970s (or specifically, didn't eat draught cattle, because privately slaughtering them was illegal). But the bigger context was that after the defeat of the National Army in 1949, a large number of people fled to Taiwan, including many from Sichuan, Guizhou, and other places. They had much stronger tastes than the food in Taiwan, so they started to kill cows and eat beef, preparing heavy-tasting ingredients with extremely simple methods. (Here's an aside, doesn't it sound like they were breaking the law? Strictly speaking, not really, because Sichuan had a developed salt industry, and the cows they used were not draught cows, so they were called working cows, not draught cows…). In this way, Taiwan, due to the influx of mainland people, was forced to change its food taste. Due to American free trade, a large amount of beef appeared, so there were many beef noodle restaurants in many streets. This trend lasted for a long time (there was a novelist who wrote: "Ride the fastest horse, eat the most delicious beef noodles"). Until one day, a man found this business opportunity, brought it back to the mainland, and established a company that sold 200 million packs a year within 2 years.

- So, what does this have to do with trends? Because as I mentioned earlier, the Asian Tigers rose in the 1970s, and Taiwan's rapid industrial development in the 1970s transformed beef noodles from snacks to street fast food. The intense taste experience made workers feel satisfied instantly, and the strong taste of the seasoning also covered the disadvantage of non-fresh ingredients (after all, it's cheap, so it doesn't matter if it's not fresh...). The connection between this story and the big economic trend is that Taiwan's industry took off in the 1970s, while the mainland's did in the mid-1990s. The path that Taiwan experienced is something that the mainland will definitely experience again because this is natural trend, and it won't be changed by outer forces. The rapid industrial transformation of social development requires the strong taste of instant noodles.

- I'll talk about some other examples. I won't discuss the "extreme feminism" before the 1980s (because I believe that women can't possibly have rights in a non-fully industrialized era. The equality of women and men is essentially that the ability of males to earn resources through physical functions can be replaced by females through intellectual work. Before the process of industrialization, when resources were obtained through pure labor, women just couldn't be equal to men). The decline of Japan's "extreme feminism" from 1980 to 1995, isn't it very similar to our so-called "extreme feminism" a few years ago? One thing needs to be clear here, when women as a whole cannot survive solely on their own abilities, once an event like an economic crisis occurs, even if the average returns received by men and women decrease at the same proportion, women's plight in life is still much more serious than men's. In order to survive, the so-called "extreme feminism" will definitely collapse in a bad economy. This natural law will definitely be replayed in the future.

I'm done writing. It has been too long already. All these criticisms here and there only makes me look like some young guy without that overestimate himself.