First and foremost, the conclusion: If top leaders still want China's economy to continue generating profits for them, they must address the domestic debt issue. There are two primary solutions:

- Rapidly developing new growth points (which is nearly impossible);

- Pacifying investors using effective strategies and diverting the focus from contentious issues.

Transferring state-owned assets to debt owners is a viable method, and when combined with the introduction of property tax and measures to stabilize housing prices and protect banks, the six trillion yuan debt (excluding hidden debts) may not be insurmountable.

Here are some commonly used methods to address the debt issue:

- Transfer of State-Owned Assets: There are precedents for this, though they are rare and very specific. In the years 2019 and 2020, Maotai, largest company in market cap in A-share market, transferred 8% of its shares to Guizhou State Assets Investment Company to address a debt of 160 billion yuan (2 trillion market cap at that time). The challenge with this method is that not all regions have large companies as Maotai. For most regions, having a company worth 100 billion yuan is quite an achievement. Out of the 5,000 companies listed on the A-share market, the majority are in Beijing, Zhejiang, Jiangsu, Shanghai, and Guangdong, collectively accounting for roughly 80% in quantity. (I couldn't find the latest market cap data, in 2016 Beijing held 28%, or 14 trillion yuan, Guangdong was second with 16%, or 7.8 trillion yuan, followed by Shanghai with 10%, or 5 trillion yuan, and then places like Zhejiang and Jiangsu. In terms of state-owned enterprise (SOE) market cap rankings, in 2020, SOEs accounted for 32%, or 25 trillion out of 80 trillion yuan). If an average of 5% of the 25 trillion is used (which is likely a conservative estimate), it could address 1.25 trillion yuan of debt and interest. Even if this asset transfer lasts over three years, combined with various extensions and possibly even without the implementation of a property tax, the debt issue could be successfully postponed for another seven to eight years. Moreover, following the Covid crisis, the policy focus of 2020, 2021, and 2022 has been to increase the weight of SOEs to 50%, combined with the "Chinese Unique Valuation System", which essentially means enhancing the valuation of SOEs. This would legitimize the inflation of asset values, providing a legal way to address the debt issue.

- Use of Project Carry-over Funds: Repaying through operational income (It's worth noting how most state-owned enterprise assets are underperforming, so this isn't a likely solution).

- Debt Transformation: Promote the transformation of urban investments, converting implicit debts into corporate debts, repaid through operational profits, essentially through cash flow (question from SOE: What's cash flow?).

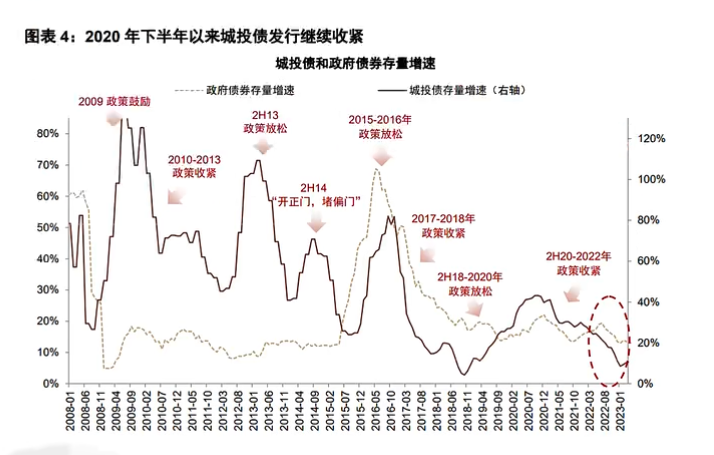

- Bond Replacement or Extension: Starting with Zunyi and becoming increasingly common, even potentially forming an industry chain. In the future, situations where a corporate bond is only extended by 5 or 8 years instead of 20 might be seen as good news.

- Bankruptcy Restructuring or Liquidation: This is highly unlikely. Domestic debt isn't considered "real" debt in the conventional sense, so such drastic measures are unnecessary. The Communist Party of China doesn't operate like the bipartisan system in the U.S., and won't take actions that could jeopardize the interests of its leaders.

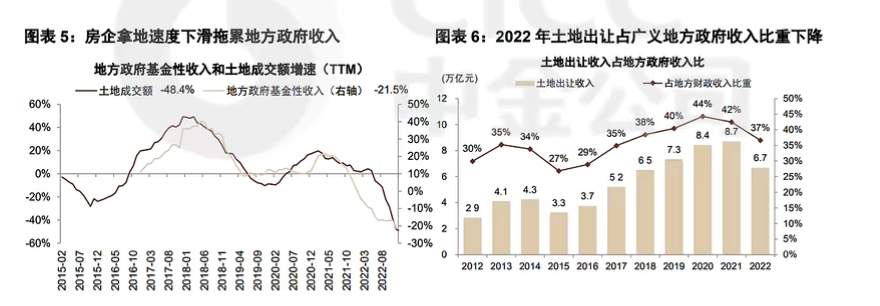

- Repayment Through Fiscal Funds: This would mainly come from annual budget funds, extra revenue, and revitalizing fiscal stock funds. However, after the Covid crisis and subsequent housing issues, local governments have largely been impacted by a crisis in land finance. The decrease in land sales income has already placed significant pressure on central fiscal transfers, so relying on additional fiscal funds seems improbable.

Further details on bond exchanges and extensions (based on a CICC report):

Main forms include:

- Replacing bonds - use loans from China Development Bank, and commercial bank to replace high-cost debt. For instance, since 2019, bonds have been issued by pilot counties to refinance implicit local government debt. As of July 2021, out of the 612.8 billion yuan quota set for this purpose, 609.5 billion yuan had already been issued. Additionally, since 2021, refinancing bonds in Guangdong and Beijing have been used to replace implicit debt.

- Extending debts - Existing debt is extended to "buy time", which reduces interest costs for city investment companies. For example, in December 2022, Guizhou City Investment Zunyi Bridge announced a bank loan restructuring, with a debt size of 155.94 billion yuan. The loan term was extended to another 20 years, with interest rates set between 3% to 4.5% per annum. Only interest is paid in the first 10 years, and principal is repaid in instalments over the next 10 years.

However, a note from me: the premise for extension is to have a stable and quality income. SOEs without cash flow can’t use these methods: they just need to find their sugar daddy.

The statement from the Ministry of Finance is quite telling:

We believe the future path to resolving local implicit debt may have the following characteristics:

- Adhere to the principle that the central government won't bail out, following the idea "you handle your own problems," breaking the expectation of the central government always coming to the rescue.

- Cautiously and orderly resolve the implicit debt without widespread defaults, and avoid risks from mishandling it. The likelihood of public city investment bond defaults this year is almost impossible. (shows central government’s attitude: stability matters more than anything else)

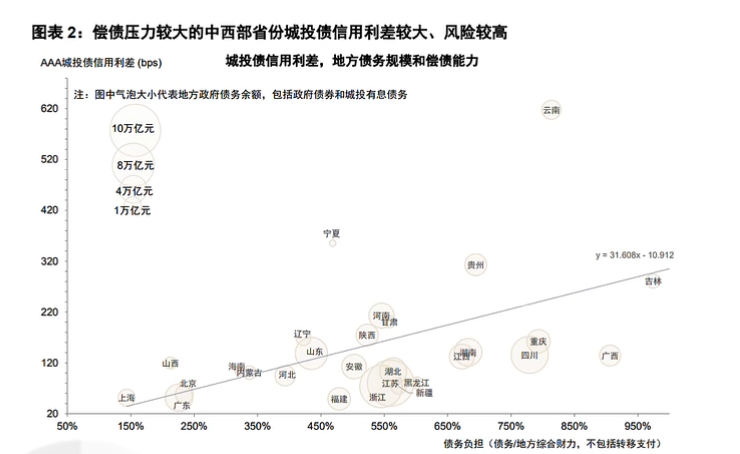

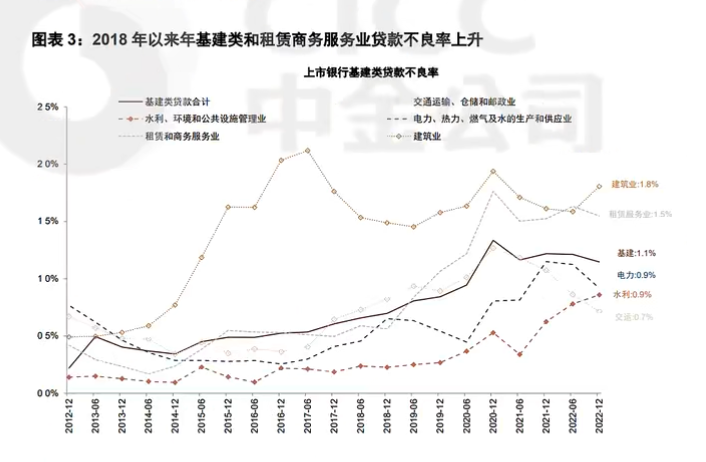

- Some weak city investments in central and western regions might have rising bad asset rates on balance sheet and off balance sheet. They might resolve risks through restructuring and extensions, but the risk is manageable.

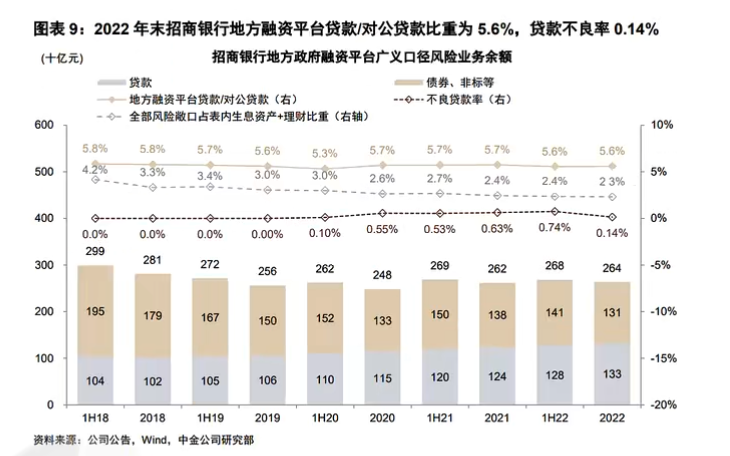

In January 2023, the Banking and Insurance Regulatory Commission proposed: "Actively assist in resolving the risks of implicit local government debt, orderly carry out local government debt replacement, promote optimization of debt maturity structures, and reduce interest rate risks."

This essentially means forcing banks to help with the debt problem, pressuring them to agree to methods like extensions. But how to handle actual bad debt? Sell financial products, of course! The only risk here is, as people gradually become poorer, how much "naive" money will be available to support it.

A more pessimistic view, which is mine, is:

Capital isn't foolish. Everyone knows how bad the assets of local state-owned enterprises (SOEs) are. Many can't even cover their interest, let alone turn into a profit, and many lack cash flows, like some highways and bus companies in the central and western regions. Thus, private capital won't buy local SOE assets. While brands like Maotai are rare exceptions that can't be replicated, banks will probably have to pick up the slack, continue issuing financial products, and leave the unsuspecting general public to foot the bill. To dilute the default rate, the central bank might step in to swap high and low-interest debts, which could be a reason that the M2 money supply is skyrocketing. (Hence, I reiterate, anyone who buys bank stocks for long-term holding is foolish.) The debt won't vanish but will merely shift. This is a tragedy for our generation, and perhaps we were just unlucky not to live during a golden age.

A small prediction: In the coming years, we'll see many high-ranking officials, landlords, and business elites being arrested or fined.

(Note: What Chinese leaders really need are landlords, not capitalists, because landlords are like ATMs, making money with the leaders and having nowhere to run.)

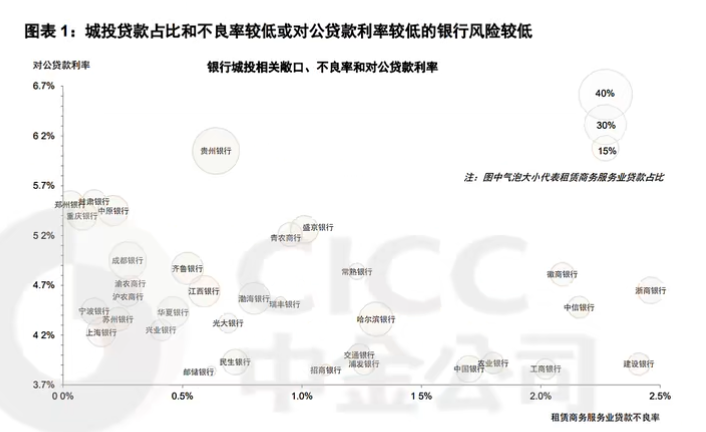

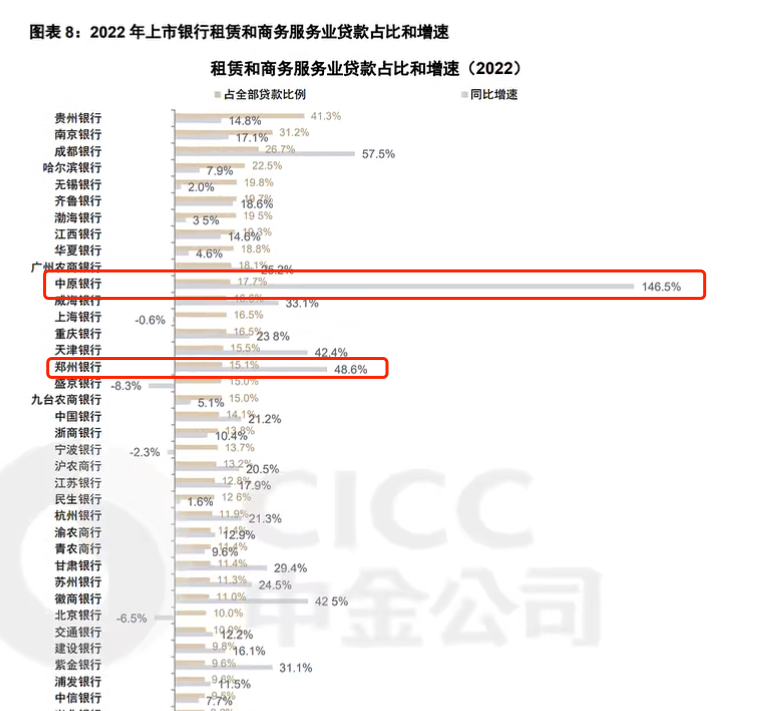

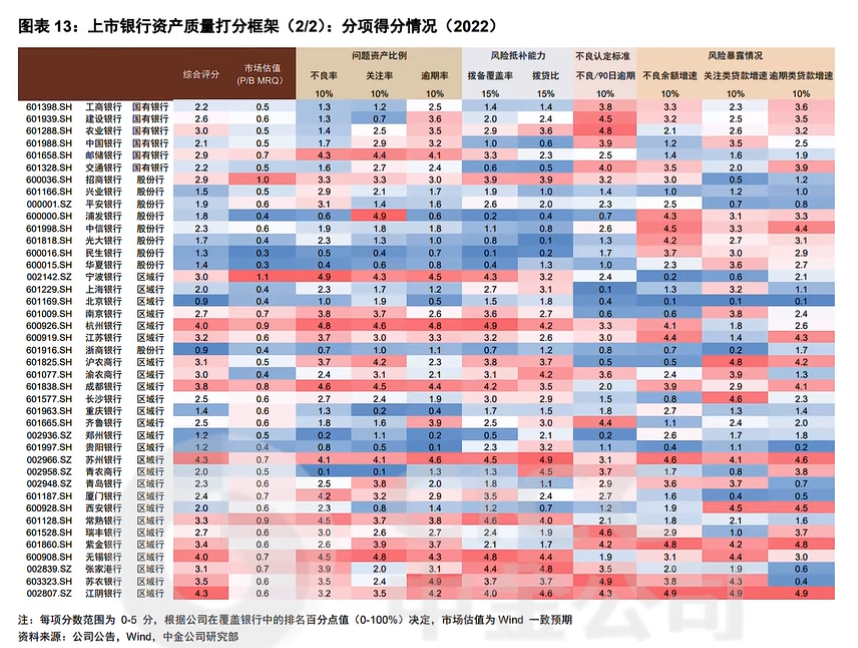

Below are some charts from CICC which are quite interesting. Take a look yourself and notice the disparities between provinces and banks. Maybe you can even arbitrage a bit:

(Only in Chinese)

And experience the charm of Zhengzhou (Data from 2022 clearly demonstrates how disgusting the real estate development in Zhengzhou is!):

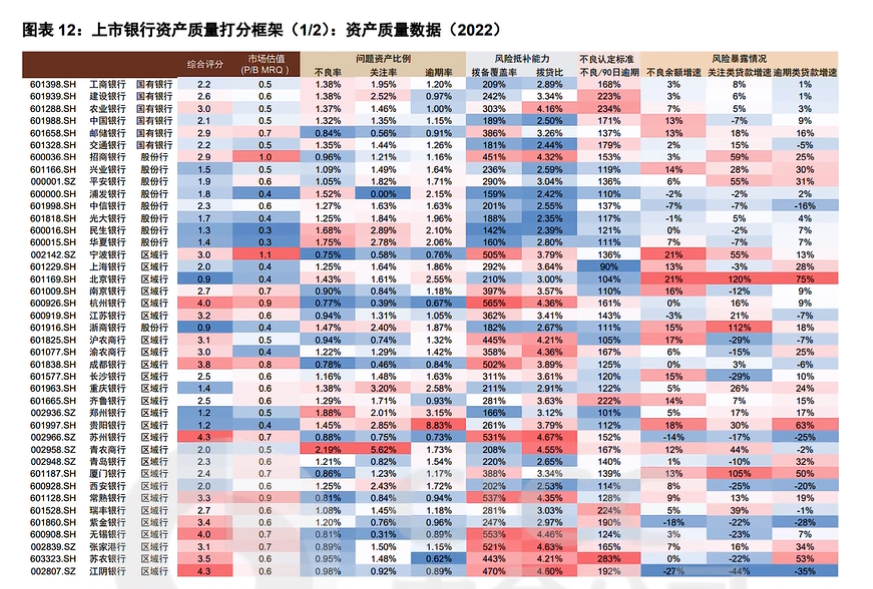

I doubt the authenticity of the following:

Similarly, data shows that by the end of 2022, Ping An Bank had no non-performing loans (0%) (even when local loans accounted for 6% of its portfolio). This reminds me of Nanjing Bank (or was it Ningbo Bank? I can't remember clearly). With such a superb bad loan rate, how come they are out of money? The non-performing asset rate for Industrial Bank is slightly higher, reaching 1.23% in 2022, 3.37% in 2021, and 1.97% in 2020.

Here, red indicates positive meaning. Good banks include Suzhou Bank, Ningbo Bank (though I don't regard this one as good), Chengdu Bank, Wuxi Bank, etc. High scores are mainly attributed to the non-performing loan rate (which can easily be fabricated) and provisioning rate (which is harder to fake).

Regarding the authenticity of the data, I believe it is generally understated, especially the default rate. Many have been wiped out by implicit debt through various forms of replacements.