Rent-to-Price Ratio

Note: This method is suitable only for comparing the wealth gap between different cities within the same country. It cannot be used for comparing different countries (mainly because macroeconomic policies vary among countries. For example, China has property purchase restrictions, while many European countries do not).

- Normally, those in finance will look at the Gini coefficient. However, due to the high chance of data manipulation and the complexities of income statistics, it's cumbersome.

- The simplest way is to observe the rent-to-price ratio of a city: Weighted Average Rent / Weighted Average House Price. The smaller the rent-to-price ratio, the larger the wealth disparity. Major cities in China generally have a rent-to-price ratio of less than 2%. Inside Beijing's Fourth Ring Road, it's roughly around 1.2% (estimated).

Explanation:

- The pricing power of a city's real estate is determined by the wealthiest group in that city. Due to limited supply and various factors like land-based fiscal policy, developers and the government will raise prices, pushing them higher.

- The pricing power for renting in a city is determined by the poorest group in that city. If landlords charge too much rent, tenants can simply opt not to rent or even relocate to another city for work. Rental prices are more demand-driven.

- Therefore, the smaller the rent-to-price ratio, the higher the house price is in comparison to the rent, indicating a larger wealth disparity.

- In China, it's generally around 2%

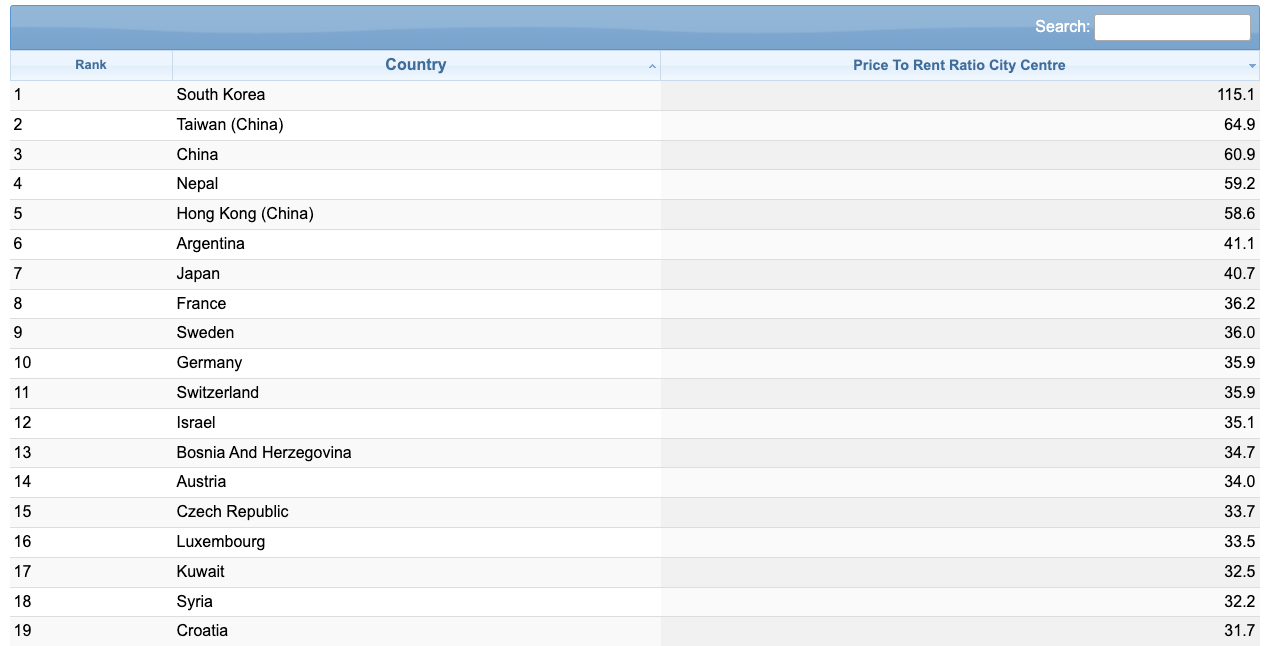

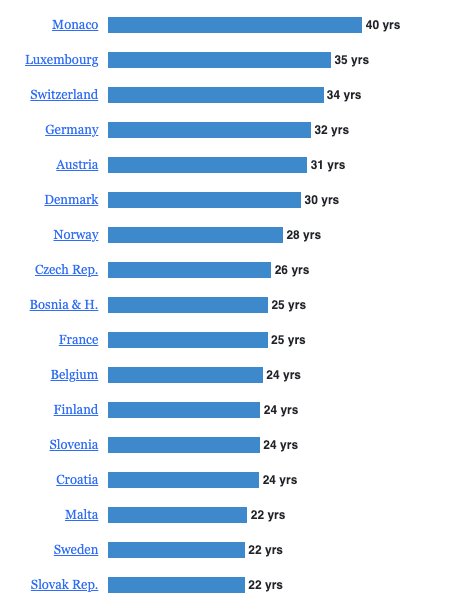

- You can find some related information on this website: https://www.numbeo.com/property-investment/rankings.jsp?title=2023

It's truly alarming: